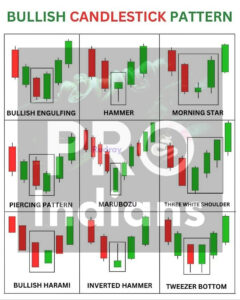

Bullish Candlestick Patterns: A Guide to Identifying and Understanding Key Reversal Signals

Candlestick patterns are a popular tool used by technical analysts to predict future price movements in financial markets. These patterns, formed by the open, high, low, and close prices of an asset, can provide valuable insights into market sentiment and potential reversals. In this article, we will explore some of the most significant bullish candlestick patterns and how they can be used to identify potential buying opportunities.

1. Bullish Engulfing

The Bullish Engulfing pattern, a notable two-candle reversal formation, typically manifests at the conclusion of a downtrend. It materializes when a diminutive bearish candle precedes a larger bullish one, entirely engulfing the former’s body. This occurrence signifies a notable shift in market sentiment, transitioning from bearish to bullish, hinting at a possible reversal in trend.

In addition traders frequently seek additional confirmation of the bullish engulfing pattern by scrutinizing various technical indicators or support levels. By doing so, they aim to corroborate the signal’s validity and enhance the likelihood of executing a successful trade.

2. Hammer

The Hammer is a single-candle pattern that can appear at the end of a downtrend. It is characterized by a small body and a long lower shadow, resembling a hammer. The presence of a hammer suggests that buyers have stepped in and are pushing the price higher, potentially signaling a reversal.

Furthermore traders often interpret the hammer pattern as a bullish signal when it appears after a prolonged downtrend. However, it is essential to consider other factors, such as volume and trend confirmation, before making trading decisions based solely on this pattern.

3. Morning Star

The Morning Star pattern signifies a potential trend reversal and comprises three candles. It starts with a long bearish candle, followed by a small-bodied candle that gaps below the preceding one, and concludes with a long bullish candle that engulfs the prior two. This pattern indicates a reduction in selling pressure and a rise in buyer control.

Moreover in this traders often consider the morning star pattern to be a strong bullish signal, especially when it appears at support levels or after a prolonged downtrend. However, it is crucial to wait for confirmation from other indicators or price action before entering a trade based on this pattern.

4. Piercing Pattern

The Piercing Pattern is a two-candle reversal pattern that occurs at the bottom of a downtrend. It is formed by a long bearish candle, followed by a bullish candle that opens below the previous candle’s low but closes above its midpoint. This pattern suggests a potential shift in market sentiment from bearish to bullish.

Also, traders often look for confirmation of the piercing pattern through other technical indicators or support levels. This can help validate the signal and increase the likelihood of a successful trade.

5. Marubozu

The Marubozu pattern features a single candle with a long body and minimal to no shadows. It can be either bullish or bearish, depending on whether the candle is green (bullish) or red (bearish). The absence of shadows indicates strong buying or selling pressure throughout the trading session.

Also, traders often interpret a bullish marubozu as a sign of strong buying interest and potential continuation of an uptrend. However, it is essential to consider other factors, such as volume and trend confirmation, before making trading decisions based solely on this pattern.

Must Visit: One Trading Guide to Understand and Use Easy Candlestick Patterns.

6. Three White Soldiers

The Three White Soldiers pattern is a bullish reversal pattern that consists of three consecutive long bullish candles with small or no shadows. Each candle opens higher than the previous day’s close and closes near its high, indicating strong buying pressure.

Furthermore, traders often interpret the three white soldiers pattern as a sign of a significant shift in market sentiment from bearish to bullish. However, it is crucial to consider other factors, such as volume and trend confirmation, before making trading decisions based solely on this pattern.

7. Bullish Harami

The Bullish Harami is a two-candle pattern that occurs during a downtrend. It is formed by a long bearish candle, followed by a smaller bullish candle that is entirely engulfed within the previous candle’s body. This pattern suggests a potential trend reversal, as buyers start to gain control.

Traders often look for confirmation of the bullish harami pattern through other technical indicators or support levels. This can help validate the signal and increase the probability of a successful trade.

8. Inverted Hammer

The Inverted Hammer is a single-candle pattern that can appear at the end of a downtrend. It is characterized by a small body and a long upper shadow, resembling an inverted hammer. The presence of an inverted hammer suggests that buyers have stepped in and are pushing the price higher, potentially signaling a reversal.

Traders often interpret the inverted hammer pattern as a bullish signal when it appears after a prolonged downtrend. However, it is essential to consider other factors, such as volume and trend confirmation, before making trading decisions based solely on this pattern.

9. Tweezer Bottom

The Tweezer Bottom is a two-candle pattern that occurs at the bottom of a downtrend. It is formed by two consecutive candles with equal or near-equal lows, indicating strong support. This pattern suggests that selling pressure is diminishing, and buyers are starting to gain control.

Traders often interpret the tweezer bottom pattern as a potential bullish signal, especially when it appears at support levels or after a prolonged downtrend. However, it is crucial to wait for confirmation from other indicators or price action before entering a trade based on this pattern.

Conclusion

Bullish candlestick patterns can provide valuable insights into potential trend reversals and buying opportunities. However, it is essential to use these patterns in conjunction with other technical indicators and price action analysis to increase the probability of successful trades.

Remember, no trading strategy is foolproof, and it is crucial to manage risk and practice proper risk management techniques when implementing any trading strategy.

Know Your Personal Brand On LinkedIn: Elevate Your Professional Presence.